ARTICLE AD BOX

Koh Ewe

BBC News

Reporting fromSingapore

Nick Marsh

BBC News

Reporting fromKuala Lumpur

Astudestra Ajengrastri

BBC Indonesian

Reporting fromJakarta

Getty Images

Getty Images

South East Asia is an obvious choice for Chinese exports to the US that are now looking for new markets

When US President Donald Trump hit China with tariffs in his first term, Vietnamese entrepreneur Hao Le saw an opportunity.

His company is one of hundreds of businesses that have emerged to compete with Chinese exports that have increasingly been facing restrictions from the West.

Le's SHDC Electronics, which sits in the budding industrial hub of Hai Duong, sells $2m (£1.5m) worth of phone and computer accessories every month to the United States.

But that revenue could dry up if Trump imposes 46% tariffs on Vietnamese goods, a plan that is currently on hold until early July. That would be "catastrophic for our business," Le says.

And selling to Vietnamese consumers is not an option, he adds: "We cannot compete with Chinese products. This is not just our challenge. Many Vietnamese companies are struggling in their own home market."

Trump tariffs in 2016 sent a glut of cheap Chinese imports, originally intended for the US, into South East Asia, hurting many local manufacturers. But they also opened new doors for other businesses, often into global supply chains that wanted to cut their dependence on China.

But Trump 2.0 threaten to shut those doors, which it it sees as an unacceptable loophole. And that's a blow for fast-growing economies like Vietnam and Indonesia that are gunning to be key players in industries from chips to electric vehicles.

They also find themselves stuck between the world's two biggest economies - China, a powerful neighbour and their biggest trading partner, and the US, a key export market, which could be looking to strike a deal at Beijing's expense.

And so Xi Jinping's long-planned trip to Vietnam, Malaysia and Cambodia this week took on fresh urgency.

All three countries rolled out the the red carpet for him, but Trump saw it as more evidence of the them conspiring to "screw" the US.

Getty Images

Getty Images

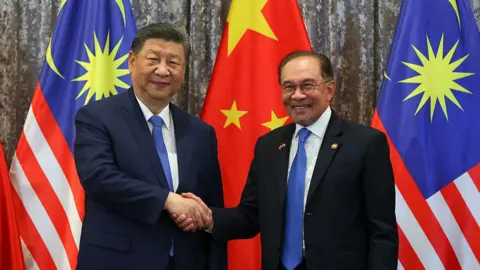

Xi Jinping met Malaysian Prime Minister Anwar Ibrahim this week when the Chinese leader visited South East Asia to shore up economic ties

The White House will use its upcoming negotiations with smaller nations to pressure them into limiting their dealings with Beijing, according to reports.

But that could be a fanciful ambition given the amount of money flowing between China and South East Asia.

In 2024, China earned a record $3.5tn from exports - 16% of those went to South East Asia, its biggest market. Beijing, in turn, has paid for railways in Vietnam, dams in Cambodia and ports in Malaysia as part of its "Belt and Road" infratructure programme that seeks to boost ties abroad.

"We can't choose, and we will never choose [between China and the US]," Malaysia's trade minister Tengku Zafrul Aziz told the BBC on Tuesday, ahead of Xi's visit.

"If the issue is about something that we feel is against our interest, then we will protect [ourselves]."

A wake-up call

In the days after Trump unveiled his sweeping tariffs, South East Asian governments scrambled into deal-making mode.

In what Trump described as a "very productive call" with Vietnamese leader To Lam, the latter offered to completely scrap tariffs on US goods.

The US market is crucial to Vietnam, an emerging electronics powerhouse where manufacturing giants like Samsung, Intel and Foxconn, the Taiwanese firm contracted to make iPhones, have set up shop.

Meanwhile, Thai officials are headed to Washington with a plan that includes higher US imports and investments. The US is their largest export market, so they are hoping to avoid the 36% levy on Thailand that Trump may reinstate.

"We will tell the US government that Thailand is not only an exporter but also an ally and economic partner that the US can rely on in the long term," Prime Minister Paetongtarn Shinawatra said.

The Association of Southeast Asian Nations (Asean) has ruled out retaliation against Trump's tariffs, instead choosing to emphasise their economic and political importance to the US.

Getty Images

Getty Images

Samsung is one of many multinationals that has come to Vietnam to diversify its supply chain

"We understand the concerns of the US," Mr Zafrul told the BBC. "That's why we need to show that actually we, Asean, especially Malaysia, can be that bridge."

It's a role that South East Asia's export-driven economies have played well - they have benefitted from both Chinese and US trade and investment. But Trump's paused levies could derail that.

Take Malasyia, for instance. In recent years, chip manufacturers from the US and elsewhere have invested there, as Washington blocks the sale of advanced tech to China. Last year China imported $18bn worth of chips from Malaysia. These chips are used in Chinese-made electronics, such as iPhones, typically bound for the US.

Trump's proposed tariffs on Malaysia - 24% - could cut off the multi-billion dollar US market. But that's not all.

"If this continues, then companies will have to rethink their investment commitments," Mr Zafrul says. "This will have an impact not just on Malaysia's economy, but on the global economy."

Then there is Indonesia, which could face 32% tariffs, and is home to vast nickel reserves and has its sights set on the global electric vehicle supply chain.

Cambodia, a Chinese ally, faces the steepest levies: 49%. One of the poorest countries in the region, it has thrived as a trans-shipment hub for Chinese businesses seeking to skirt US tariffs. Chinese businesses currently own or operate 90% of the clothes factories, which mainly export to the US.

Trump may have hit pause on these tariffs but "the damage is done," says Doris Liew, an economist at Malaysia's Institute for Democracy and Economic Affairs.

"This serves as a wake-up call for the region, not only to reduce reliance on the US, but also to re-balance overdependence on any single trade and export partner."

China's loss and South East Asia's gain

In these uncertain times , Xi Jinping is trying to send a steadfast message: Let's join hands and resist "bullying" from the US.

That is no easy task because South East Asia also has trade tensions with Beijing.

In Indonesia, business owner Isma Savitri is worried that Trump's 145% tariffs on China means more competition from Chinese rivals who can no longer export to the US.

"Small businesses like us feel squeezed," says the owner of sleepwear brand Helopopy. "We are struggling to survive against an onslaught of ultra-cheap Chinese products."

Getty Images

Getty Images

Local businesses like this one in Jakarta are bracing for an influx of goods from China's factories

One of Helopopy's popular pyjamas sells for $7.10 (119,000 Indonesian rupiah). Isma says she has seen similar designs from China going for around half that price.

"South East Asia, being close by, with open trade regimes and fast-growing markets, naturally became the dumping ground," says Nguyen Khac Giang, visiting fellow at the ISEAS Yusof-Ishak Institute in Singapore. "Politically, many countries are reluctant to confront Beijing, which adds another layer of vulnerability."

While consumers have welcomed competitively-priced Chinese products - from clothes to shoes to phones - thousands of local businesses have not been able to match such low prices.

More than 100 factories in Thailand have closed every month for the last two years, according to an estimate from a Thai think tank. During the same period in Indonesia, around 250,000 textile workers were laid off after some 60 garment manufacturers shut, local trade associations say - including Sritex, once the region's largest textile maker.

"When we see the news, there are lots of imported products flooding the domestic market, which messes up our own market," Mujiati, a worker who was laid off from Sritex in February after 30 years, tells the BBC.

"Maybe it just wasn't our luck," says the 50-year-old, who is still hunting for work. "Who can we complain to? There's no-one."

Getty Images

Getty Images

Chinese factories cannot afford to lose another key export market, such as South East Asia

South East Asian governments responded with a wave of protectionism, as local businesses demanded to be shielded from the impact of Chinese imports.

Last year Indonesia considered 200% tariffs on a range of Chinese goods and blocked e-commerce site Temu, popular among Chinese merchants. Thailand tightened inspections of imports and imposed additional tax on goods worth less than 1,500 Thai baht ($45; £34).

This year Vietnam has twice imposed temporary anti-dumping duties on Chinese steel products. And after Trump's latest tariffs announcement, Vietnam is reportedly set to crack down on Chinese goods being trans-shipped via its territory to the US.

Allaying these fears would have been on Xi's agenda this week.

China is concerned that channelling its US-bound exports to the rest of the world would "end up really alienating and aggravating" its trading partners, David Rennie, the former Beijing bureau chief for the Economist newspaper, told BBC's Newshour.

"If a tidal wave of Chinese exports ends up swamping those markets and damaging employment and jobs … that's a massive diplomatic and geopolitical headache for the Chinese leadership."

China has not always had an easy relationship with this region. Barring Laos, Cambodia and a war-torn Myanmar, the others are wary of Beijing's ambitions. Territorial disputes in the South China have soured ties with the Philippines. This is also an issue with others such as Vietnam and Malaysia, but trade has been a balancing factor.

But that might change now, experts say.

Getty Images

Getty Images

Malaysia, the world's largest maker of medical rubber gloves

"South East Asia had to think about whether they really wanted to offend China. Now this complicates things," says Chong Ja-Ian, associate professor at the National University of Singapore.

China's loss could be South East Asia's gain.

Hao Le, in Vietnam, says he has seen a surge in enquiries from American customers scouting for new electronics suppliers, outside of China: "In the past, US buyers would take months to switch suppliers. Today, such decisions are made within days."

Malaysia, with sprawling rubber plantations and the world's largest medical rubber glove maker, has nearly half the world's market for rubber gloves. But it is poised to grab a bigger share from its main competitor, China.

The region still faces a 10% baseline tariff, like most of the world. And that is bad news, says Oon Kim Hung, president of the Malaysian Rubber Glove Manufacturers Association.

But even if the paused tariffs kick in, he says, customers will find paying an additional 24% on Malaysian gloves vastly preferable to the 145% levy they will have to cough up for Chinese-made gloves.

"We're not exactly jumping with joy, but this may well benefit our manufacturers, as well as those in Thailand, Vietnam and Cambodia."

Additional reporting Tessa Wong and Abhiram V Subramaniam

1 month ago

31

1 month ago

31

English (US) ·

English (US) ·